Gift Tax 2025 Exclusion From Income

Gift Tax 2025 Exclusion From Income. But even if you exceed that amount, there are some exceptions, including a lifetime gift tax exclusion, that could prevent you from owing any tax on gifts you make. In addition, gifts from certain relatives such as parents, spouse and siblings are also exempt from tax.

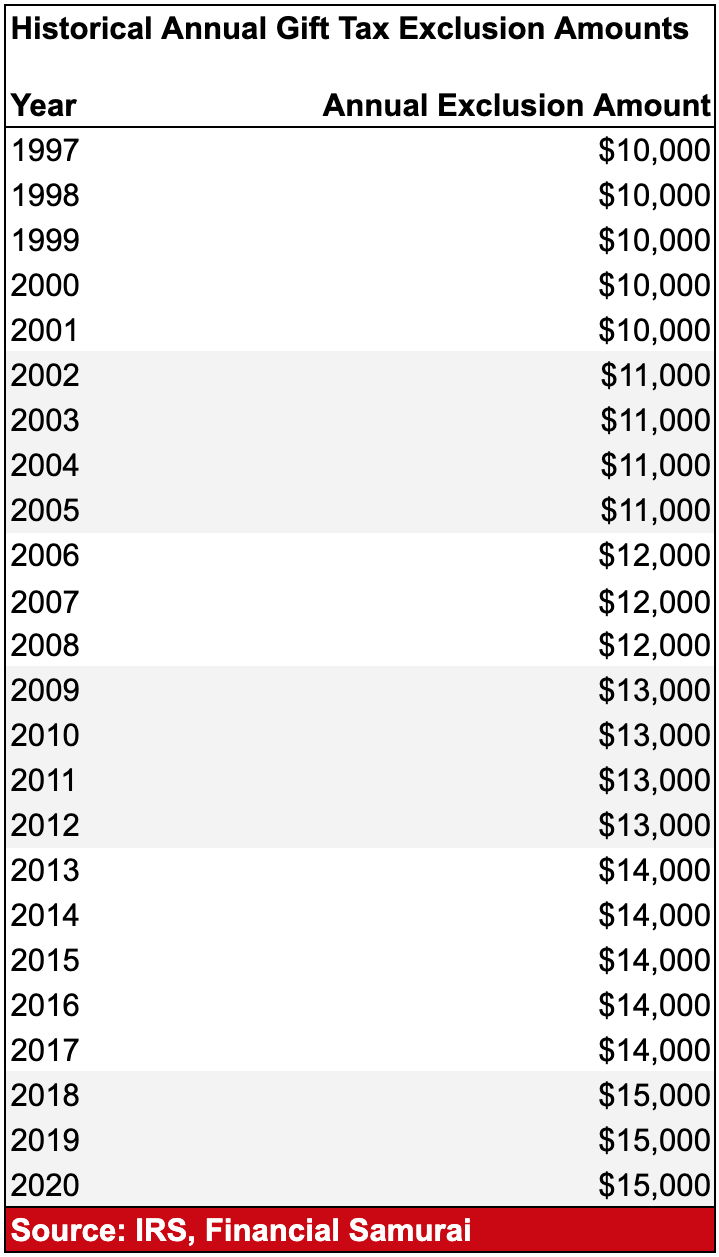

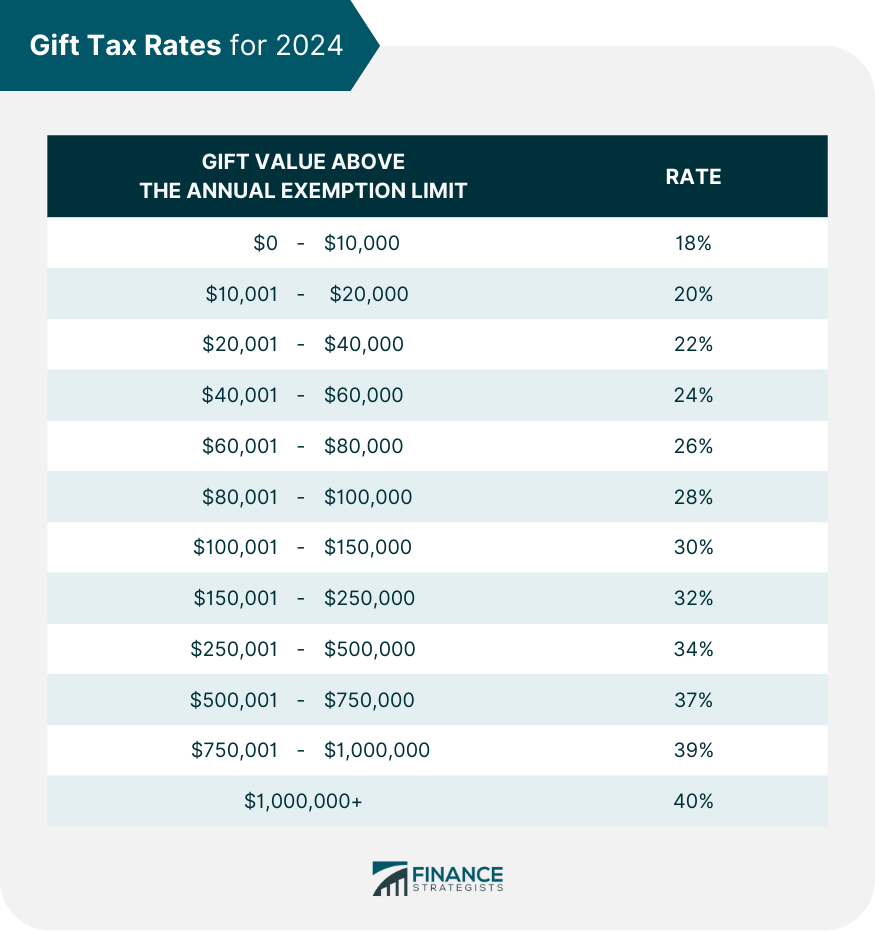

For instance, you can give up to the annual exclusion amount ($17,000 in 2025, 18,000 in 2025) to any number of people every year, without facing any gift taxes. You make a gift if you give property (including money), or the use of or income from property, without expecting to receive something of at least equal value in return.

Annual Gifting For 2025 Image to u, Let us know more about gifts and income tax applicable on gifts in india.

Annual Gift Tax Exclusion 2025 Per Person Kelli Melissa, If you give people a lot of money or property, you might have to pay a federal gift tax.

Annual Gift Tax Exclusion 2025 Amount Chart Danya Ellette, As the irs periodically adjusts this amount in response to inflation, it remains a relevant and valuable component of financial legacy planning.

Lifetime Gift Tax Exclusion 2025 Limit Lulu Sisely, In 2025, the annual exclusion stands at $18,000.

Lifetime Gift Tax Exclusion 2025 Vera Allison, In addition, the ability to use gift tax averaging means it’s.

Gift Tax Exclusion 2025 Irs Roxie Clarette, The irs typically adjusts this gift tax exclusion each year based on inflation.

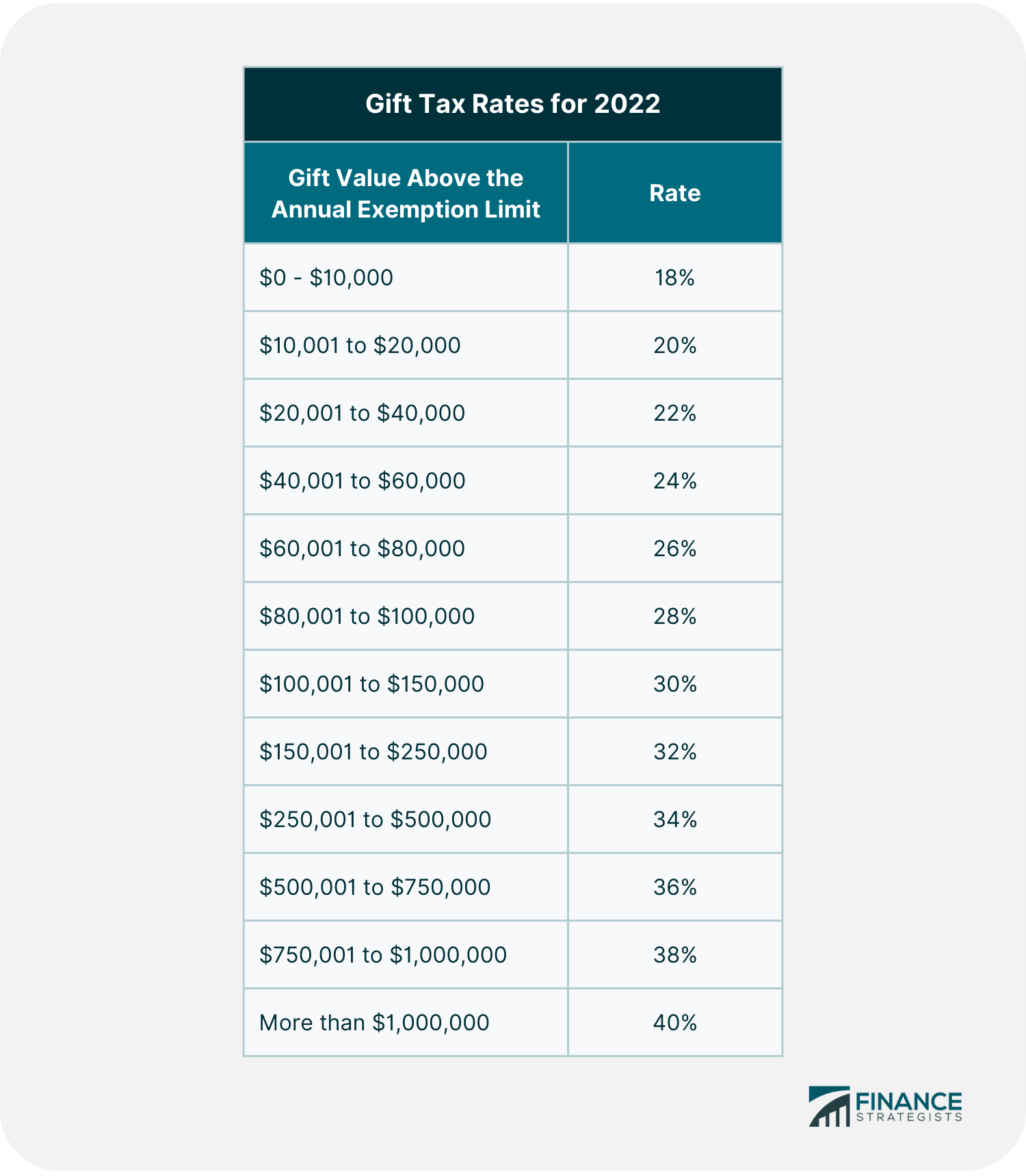

Gift Tax Limit 2025 Calculation, Filing, and How to Avoid Gift Tax, These gifts are taxed under the heading ‘income from other sources’ at the regular tax.

Lifetime Gift Tax Exclusion 2025 Irs Quinn Carmelia, This means you can give up to $18,000 to as many people as you like without any gift tax implications or the need to.

Lifetime Gift Exclusion 2025 Shel Yolane, You make a gift if you give property (including money), or the use of or income from property, without expecting to receive something of at least equal value in return.